The technology and software ecosystem for RIA firms has seen an explosion of choice over the last decade. As if the average advisor-owner doesn’t have enough to deal with from a purely business management perspective, they now must select from a vast landscape of tools that are often difficult to tell apart.

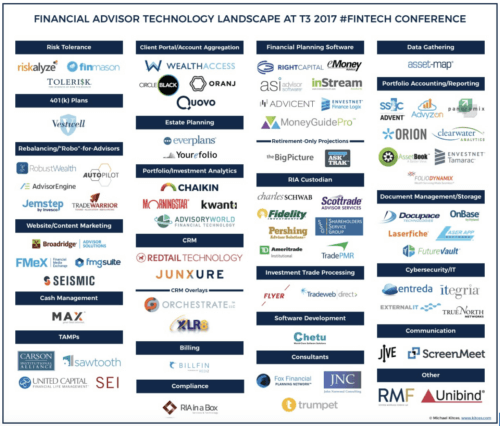

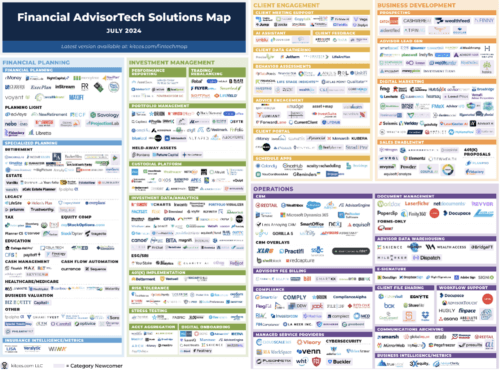

Just look at the difference between the Kitces Fintech Map in 2017 to today:

2017:

2024:

When it comes to portfolio rebalancing solutions, we’ve released the guide to selecting the best tech for your firm. In this blog, we’re taking a more expansive look across the industry to understand the full technology stack for RIAs.

Core Categories of RIA Software

To operate effectively, RIA firms need an integrated stack of solutions. Here are the core categories and key features to consider:

1. Portfolio Rebalancing

Let’s start things off with our favorite category. If you want to make sure portfolios stay in line with your clients’ strategic asset allocations and risk profiles, you need a trading/rebalancing platform. It simplifies one of the most complex and time-consuming processes a firm has to manage.

Rebalancing technology not only benefits those who leverage model portfolios but also significantly aids firms in managing completely custom portfolios by streamlining complex adjustments and enhancing accuracy.

2. Trade Order Management

Not every firm wants to simply rebalance of course, and a robust trade order management system is necessary for those advisors.

In this category, efficient execution and tracking of trades are paramount. A robust order management system (OMS) helps advisors manage trades across multiple accounts and custodians, reducing the risk of errors and enhancing operational efficiency.

The platform an advisor chooses here should support sophisticated order execution workflows, including percentage-based trading and pre-trade reviews, to ensure that trades are executed accurately and efficiently.

3. Compliance Monitoring

In such a heavily regulated industry, no advisory firm should operate without compliance monitoring tools. These tools provide built-in compliance checks, audit trails, and alerts for potential issues, helping RIAs stay ahead of their regulatory obligations before they turn into problems.

Automated compliance monitoring reduces the manual burden on advisors who act as their own Chief Compliance Officer, allowing you to focus more on client service and less on regulatory concerns.

4. Performance Reporting

Detailed performance reports provide much-needed transparency and insights to build client relationships. Even though RIAs are increasingly turning to financial planning as a key value proposition, these reports are still crucial for communication, helping advisors demonstrate the value they add through portfolio management.

Today’s performance reporting tools (which are often housed in some of the largest all-in-one platforms) generate customizable reports that not only include performance, transactions, and holdings summaries but also include value-added information like risk assessments and comparisons against benchmarks.

5. Client Communication Tools

Integrated communication tools facilitate clear and effective interactions – from compliant text messaging to interactive client portals, RIAs today have a wealth of choice for digital communication. Like many of the other tools on this list, these solutions help maintain strong client relationships and improve service delivery.

Choosing the Right Software for Your RIA

Although you can follow best practices as a starting point, selecting the right software for your RIA firm will always depend on your specific needs and operational scale.

For smaller firms, ease of use and quick implementation will be crucial. Mid-size firms benefit more from time-saving features like the ability to automate rebalancing. National RIAs, who operate most like institutional organizations, need configurable and customizable systems that can integrate and adapt to the needs of hundreds or thousands of advisors.

For Small and Mid-size RIA Firms

Growing RIAs typically need software that is easy to implement and focuses on time-saving features. With limited staff and time, getting the technology up and running quickly should be a key determinator in what choice you make.

For National RIA Firms

Large-scale RIA firms, on the other hand, have a very different set of requirements when choosing technology. These firms require software that can bring uniformity and repeatable processes across office locations that cross diverse geographical boundaries and include advisors with different backgrounds and levels of comfort with technology. Configurable systems that offer integrations through open API infrastructure are ideal, enabling these firms to fully implement the capabilities of their tech stack across systems and users.

Conclusion

The right RIA software can dramatically elevate the efficiency and effectiveness of your advisory firm. By incorporating essential tools such as automated portfolio rebalancing, comprehensive trade order management, and robust compliance monitoring, your RIA can enhance service delivery and continue to evolve in a crowded marketplace.