Order management software is a fintech category with many nuances. Sometimes an investment manager only needs a system to rebalance quarterly against a strategy. More often, the manager needs a system to regularly send orders to brokers and custodians, but their requirements aren’t much more sophisticated than that.

But if you’re an advanced trader or manager, there’s an additional component to the trading process called the Execution Management System, EMS for short, that fills those sophisticated needs. These systems are execution focused — but many investment management professionals don’t know how or why they’re different, or if they can even benefit from those differences.

If you’re serious about running an efficient trading operation and strive for the best execution for your clients, recognizing the differences and benefits of both types of systems is critical.

In this blog, we’ll look at the main differences between PMS, OMS and EMS systems and show you how it’s possible to apply the best of all three to your trading processes.

The Differences Between PMS, OMS and EMS systems

Though there’s only one letter difference between all three, the systems take a very different approach to creating and managing trades.

PMS

A PMS (Portfolio Management System) offers an “IBOR” (Investment Book of Record) allowing accurate intraday updates of cash, positions, mark to market valuation, tax lot selection and unrealized and realized gain/loss providing tax efficient trade construction. The portfolio construction tools provide a variety of ways to act on your investment decisions:

- A single security percentage of market value position trade creation

- Position swapping

- Single/multi strategy model based rebalancing workflows

- Cash deposit/withdrawal

- Single security, single account trade entry

All of these tools are necessary to accurately manage your client’s multi-asset portfolio of investments.

For more about PMS, read our Guide to Portfolio Management Software

OMS

An OMS (Order Management System) is built to manage position valuation intraday, construct orders in a variety of different ways, and perform order compliance checks to be sure that the user has some guardrails for creating orders. For trade management an OMS will provide trade blocking, trade instructions, FIX connectivity to execution destinations, algorithmic trading options, account allocations, and end-of-day (EOD) broker and custodian notification.

EMS

An EMS (Execution Management System), meanwhile, is specifically built for execution and customization. Their purpose is speed, trade volume, and analytics. This type of software doesn’t care about building and maintaining model portfolios or rebalancing accounts.

If you are an active trader, hedge fund, or long only asset manager, for example, if you care more about filling a large order at the right price than about executing a set number of shares for each account, an EMS is the system for you.

An EMS also provides real-time price quotes, and the ability to trade away from your broker and access more advanced trading methods. A unique EMS feature is the ability for the trader to build and customize its own trading algorithms to fit the specific trading needs. If you want direct market access and execute only a small percentage of a block trade (parent-child orders) to find the price you want before completing the rest, an EMS is what you want.

The Evolution of OMS and EMS

In the last ten years, many OMS providers have added EMS-like functionality since many are not built to handle the trading volume nor support IBOR functionality.

However, a typical OMS still cannot truly replace or replicate an EMS from a speed or functionality standpoint.

So if you want advanced trading capabilities, without the unwieldy UX, learning curve and cost of an EMS, what options are available?

We believe we’ve cracked the code. Here’s why.

The Co-Pilot Approach

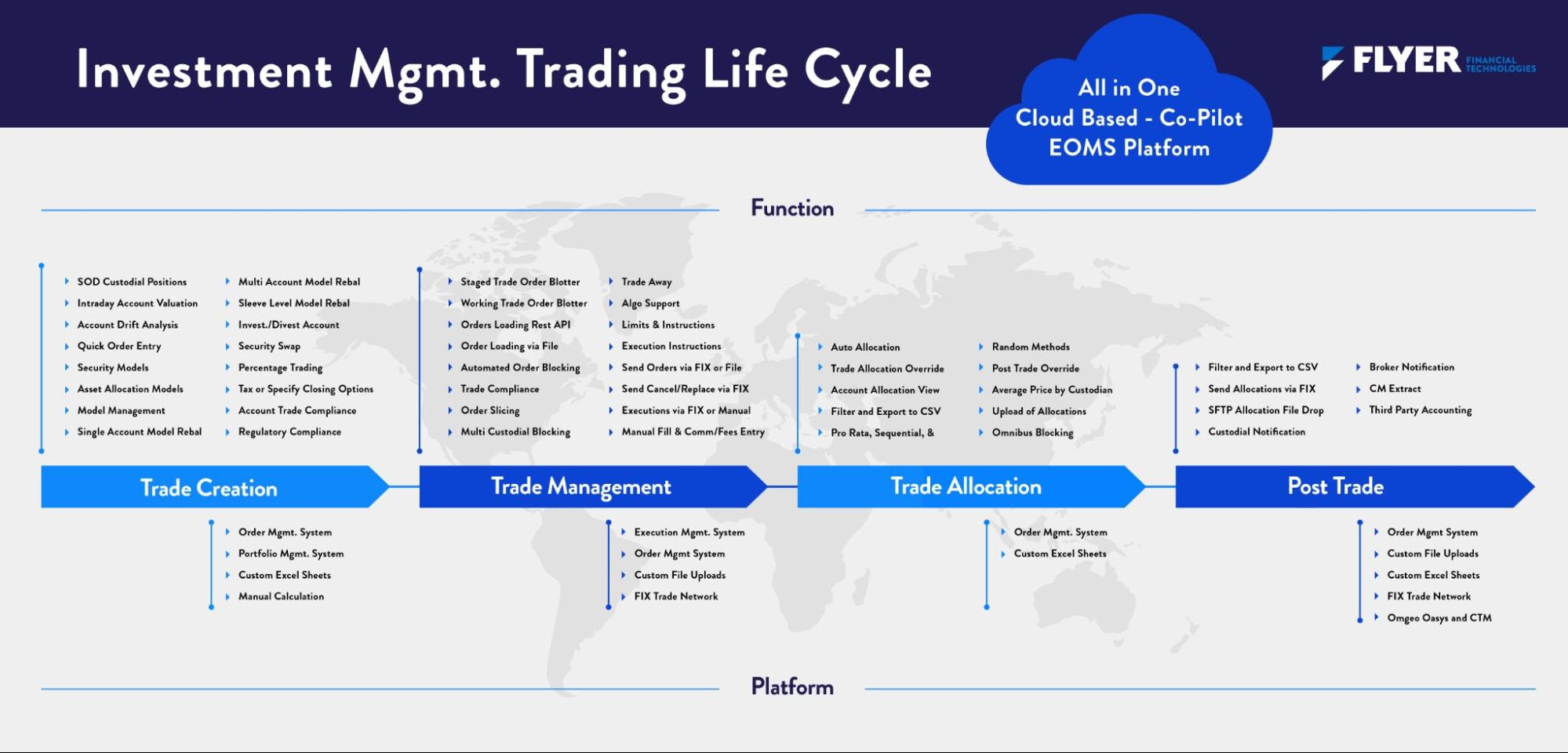

Co-Pilot started fresh by combining the best of PMS, OMS, EMS and trading network capabilities. We think of it as a hybrid system that is often referred to as an OEMS.

We can build a hybrid system because Flyer centralizes all aspects of the trading workflow under one roof – from the trade construction to OMS to EMS to trade allocation to a trading network that connects you directly to brokers and custodians.

Most OMS systems connect into a third-party trading network and put you at the mercy of the trading network operator to get connectivity, which you sometimes have to pay for to access trading venues.

Co-Pilot is tightly integrated into the Flyer Trading Network. We expedite connectivity as one company with both an OEMS and a trading network, the same operator and team. This seemingly small change improves the overall cost and time-to-market for the customer, increasing speed and efficiency while reducing costs and support problems.

With the best of PMS, OMS and EMS in one system, you can build and manage portfolios while still taking advantage of advanced trading capabilities, such as trade algorithms, to work trades most effectively with a trade counterparty of choice.

In years past, you had to call your broker to tell them how you wanted to work the trade. For example, execute 20% of an order to check the price before filling the rest. That kind of process was time consuming and a hassle. And if we’re being honest, who wants to talk on the phone anymore?

Co-Pilot makes advanced counter-party algorithms* like that as simple as choosing your options in the software before sending your block order — ensuring your trades are worked and filled the way you want, how you want, when you want.

Understanding Trading Algorithms*

Algorithmic trading uses a defined set of instructions (an algorithm) to place a trade. The trade, in theory, can generate profits at a speed and frequency that is impossible for a human trader. The defined sets of instructions are based on timing, price, quantity, trading volume (volume-weighted average price). Algorithmic trading attempts to strip emotions out of trading, ensuring the most efficient execution of a trades without the need for verbal instructions with the counterparty.

Many Brokers and Custodians offer a variety of pre designed trade algorithms requiring the trader to select the algorithm and the parameters. Having the trader choose the parameters values allow them to customize the algo for their needs.*

Get The Best of Everything

Advisory firms and asset managers no longer need to choose between a PMS, OMS, EMS, and trading network. With Flyer, the PMS, OMS, EMS and trading network have been brought together into a single platform to the benefit of the customer.

If you’ve used and like your OMS but were curious about EMS capabilities, Co-Pilot brings the most in-demand features to you without the learning curve.

And if you were using an EMS but felt like you were missing out on updated UX and UI offered by OMS platforms, Co-Pilot helps there too.

Click here to schedule a discovery call with Flyer to see Co-Pilot in action.