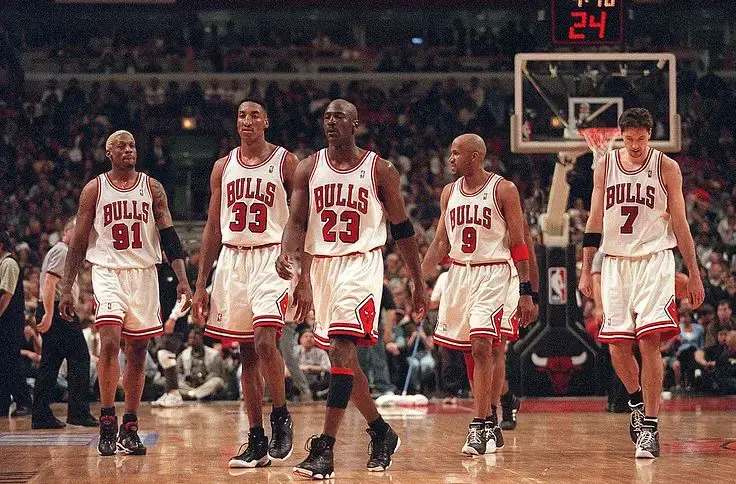

“Talent wins games, but teamwork and intelligence win championships.”

– Michael Jordan

Introduction

Teamwork was a key driver behind the incredible success of the Chicago Bulls in the 1990’s when they won six NBA championships. While Jordan was their leader, he couldn’t have won it all on his own. He needed the combination of Scotty Pippen’s strong defense, Steve Kerr’s clutch three-point shooting and Dennis Rodman’s prolific rebounding to defeat the competition. Diverse skillsets working in perfect harmony make a group that can’t be beat.

Teamwork among technology providers is also a critical component of every RIA’s success. This is especially true when it comes to their wealth platform and order management system (OMS). If these two modules are not working from the same playbook, the RIA using them can quickly find their business unable to keep up with the rest of the field.

Industry-leading technology provider Envestnet|Tamarac knew its platform was a Hall of Fame-level player in the RIA space, but they needed a world class OMS to be the Pippen to their Jordan and form an invincible duo. But where could they find an OMS with the depth and breadth of functionality as well as open architecture and flexible API access?

Tamarac selected Flyer Co-Pilot as their first-round choice to deliver their world-class, fully integrated order management system to their Tamarac clients. Co-Pilot is a custodian neutral, multi-custodial SaaS platform for advanced trade and allocation management for equities, ETFs, mutual funds, and other asset classes.

Why was Co-Pilot selected from the dozen or more top OMS systems? There are a number of key benefits that set Co-Pilot apart from the competition.

Partnership Benefits

Enhanced Visibility

Tamarac recognized the need for more advanced trade order management footprint for their current and prospective RIA clients. With Flyer, Tamarac gains enhanced visibility into their orders with centralized trading on a single blotter. The trader gains visibility across multiple custodians and brokers reducing the risk of errors, as well as better block trading. Flyer’s software is able to allocate shares into any configuration of accounts while an order is executed over multiple trading sessions, rather than simply allocating the partial executed orders pro rata.

Many offline workflows also fall by the wayside, including manual tracking of step out trades, which can now be traded over time and tracked on a centralized trade blotter. There are also no more separate trade files required for mutual funds.

Sophisticated Order Management

Access to broker trading algorithms is becoming table stakes for many RIAs. Greenwich Associates estimated that electronic trading represent about 55% of U.S. equity trades and Reuters suggested that automated trading accounts for about 75% of all financial market volume. Tamarac clients do not want to be left behind by these trends.

Flyer Co-Pilot allows for trade aways within the software, eliminating the need for phone calls, emails and spreadsheets for tracking orders sent to different brokers. It also offers access to broker algorithms, such as volume weighted average price (VWAP), percentage of value (POV) or implementation shortfall (IS), rather than just time weighted average price (TWAP).

While TWAP is simpler to manage manually, with an automated process provided by Co-Pilot, complicated algorithmic trades can be executed on smaller orders, or trades happening earlier in the day, without overwhelming the trading staff. Order routing and order handling capabilities will also be improved and access to a wider selection of brokers and other execution services provide greater accessibility to liquidity and price discovery. Of course, Co-Pilot and Tamarac users will benefit from the seamless integration, including single sign-on to both systems and tight data integration.

Speed to Market

While Tamarac could have spent millions of dollars to upgrade their own OMS, partnering with industry leader Flyer allows them to bring one of the best trading platforms to their Tamarac clients today. Flyer’s OMS has been in production for over a decade and processes orders for some of the largest buy-side firms and TAMPs on the street. They have the time-tested experience and prime time technology to support this strategic partnership.

Three Case Studies

Three brief case studies of RIAs taking advantage of Flyer Co-Pilot benefits:

- Case Study 1: An RIA that primarily works with Mutual Fund Wrap programs and uses Sungard Global Network for connectivity. The advisor was required to export all fund orders to a flat file and upload them separately to custodians or directly to the mutual fund companies. When there was a problem with an order, it was difficult to determine whether the issue was with Sungard or their OMS. Co-Pilot delivers straight through processing (STP) connected via Flyer Trade Network (FTN), which is managed by the same operations team. Only one call to Flyer is required to take care of all issues and the status of all orders are updated on the centralized trade blotter.

- Case Study 2: An RIA with around $900 million in AUM across three custodians had to process all trades manually. This meant constant calls to each custodian’s trading desks to manage orders, which was expensive and provided limited visibility. With Flyer, an order can be directly sent to a VWAP algorithm to break it up into smaller orders and sent to market automatically. The RIA trader can see exactly how the order is performing through its life cycle and tweaks can be made to improve execution. FTN provides speed to market and potentially better execution by offering access to a larger set of brokers and custodians via FIX.

- Case Study 3: An RIA with $3.3 billion in AUM, running both managed accounts and a small hedge fund, had to create lots of offline workarounds on half a dozen or more spreadsheets to manage their allocations. Client orders were blocked up but deciding on allocations was complicated and manual errors in a spreadsheet could wreak havoc on allocations, if uploaded to a custodian. With Co-Pilot, everything is centralized, automated and transparent across the firm. There are no more allocation errors and client ticket charges are reduced as allocations are optimized based on a set of criteria, especially when trading away. A single blotter can also be shared between multiple traders allowing trades with the same side, symbol and destination to be blocked, but also allowing for tight control of what each trader is able to view within the blotter.

Envestnet|Tamarac – Flyer Partnership

This new partnership between Envestnet|Tamarac and Flyer will deliver enhanced order visibility, sophisticated order management and speed to market to RIAs using Tamarac. No matter their size or previous trading experience, Flyer Co-Pilot OMS will allow them to leverage an institutional-strength centralized trade blotter with access to a wide range of broker algorithms that will be seamlessly connected to the rest of the Tamarac platform.

While we don’t expect any advisors to win the NBA Championship six times, the team of Tamarac and Flyer does bring world class technology that should be in the RIA Hall of Fame.

Contact your Tamarac client representative for more information about setting up FIX Flyer Co-Pilot OMS at your firm.